THIS Is why 82% of Entrepreneurs FAIL

May 24, 2022SUMMARY

- "There really is only 1 way to go out of business, and that's if you run out of cash."

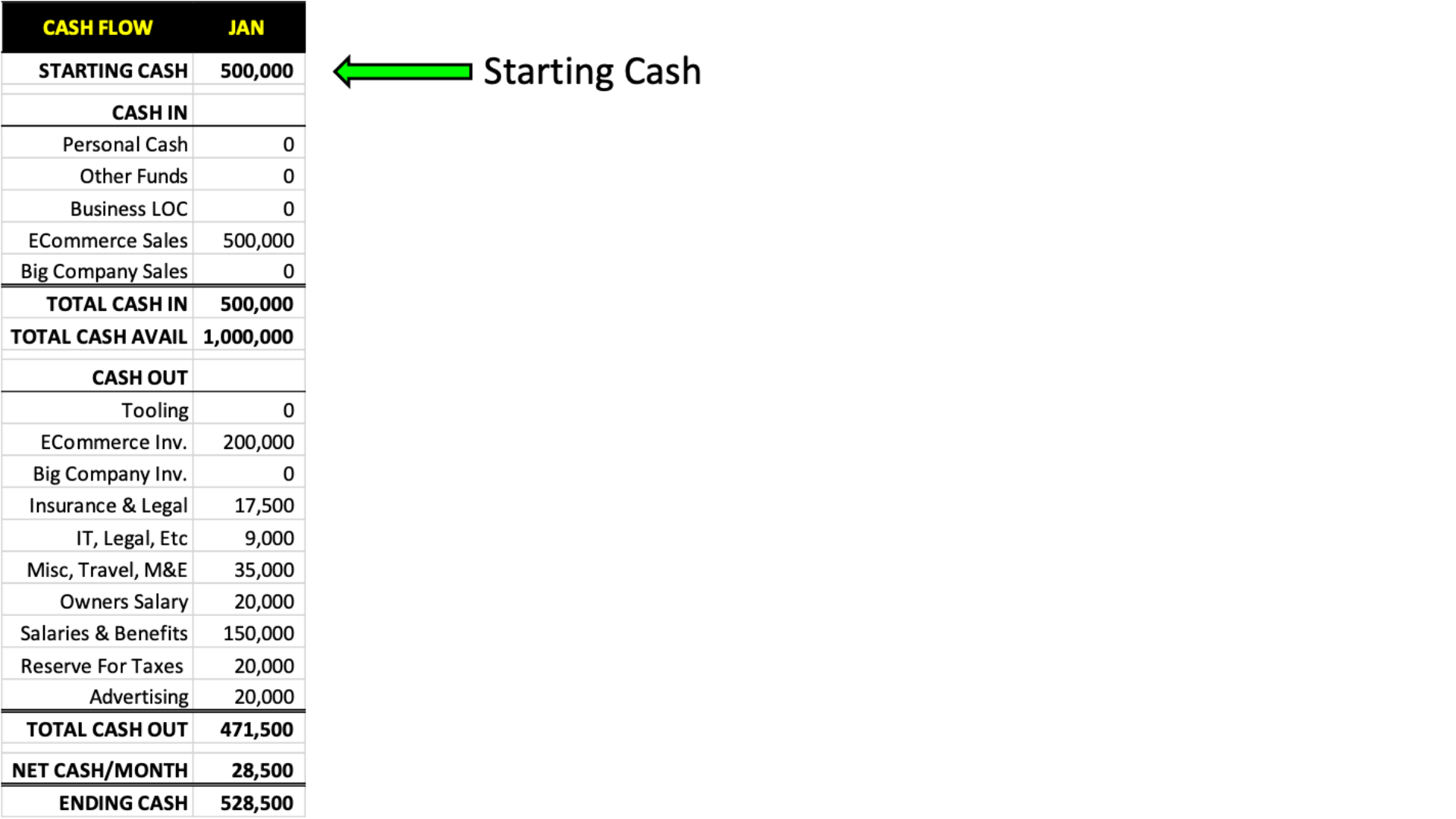

- The Savage Secrets Cash Flow Tracker™ takes all the complexity out of your Cash Flow statement. Simply plug in your own numbers and get rolling. You can download it here: https://thesavagesecrets.com/cashflow

- When you're trying to GROW you business, it is really difficult to run your company without a solid understanding of cash flow.

- An Income Statement is like a Report Card. It's your results over a period of time. A Balance Sheet shows the net value of your business, in a moment in time. Cash Flow is like your heart pumping blood throughout your body. "Cash Flow is constantly working."

- This episode is a deep dive into the ins & outs of a Cash Flow Statement. You'll go through a real life example to simplify the concept and make understanding easy.

- If you have questions on the spreadsheet or another business challenge, shoot me an email at [email protected].

FULL TRANSCRIPT:

"Welcome back to my 10 Biggest Mistakes Building Companies, Number 7. Cash must flow. It is the lifeblood of all of our businesses, of all of our organizations."

The One Way to Go Out of Business

"82% of businesses fail because of cash flow.

Now, this information comes from the Small Business Administration and SCORE. I'm not 100% sure what it means. It seems to me like there are lots of things that can get in the way of business success. I've seen it. I've coached hundreds of entrepreneurs and I just know that there is this world of building companies that can be pretty challenging. There is a lot that goes into it, but one thing is for sure: there really is only one way to go out of business. And that is if you run out of cash.

It's really difficult to continue to run your business, especially if you're trying to grow, without an absolutely solid understanding of cash flow. So I am going to share with you the nuts and bolts, the ins and outs. I do not want you to be scared. If you do not like numbers, don't worry about it! I promise you, I will be able to make this pain-free."

How Businesses Can Survive the Unexpected [e.g. the Covid-19 Pandemic]

"I'm not sure when you're watching this, but right now it's the year 2022, and we're coming out of the Covid pandemic. Many businesses out there today were incredibly pressured during Covid. They continue to be incredibly pressured. But the businesses that are still here (It's all industry dependent. You know, for some industries Covid was the greatest gift in the world! Other industries it was a death sentence, quite frankly.), those that are around had cash. A lot of industries were absolutely bloody because of Covid, but they had enough cash to get through. So cash is the most important thing. I'm going to take you through some things that you can learn in your business so that you understand the ins and outs of cash."

Who Am I To Teach You About Cash Flow?

"First off, who am I? I am a serial entrepreneur, my name is Mike Savage. I've been building businesses for the last 30 years in a variety of different industries. I built a few multi-million dollar companies. My largest business grew to $25 million. I had 50 employees. Sold about a quarter of a billion dollars in product and services to the world's leading retailers.

I have also been a mindset junkie since I was in high school. I got introduced to a dude whose name is Zig Ziglar, and that took me from the things that I had plugged into my brain ever since birth, and it started to trickle in these things that I had never heard before. I hadn't heard them from my parents, hadn't heard them from anywhere else. So I've become kind of obsessed with this thing that sits on our shoulders, and how we can influence our thoughts and behaviors.

Bottom line is, I've been through a lot of stuff as an entrepreneur. I'm battle tested, and I always say, 'The greatest learning laboratory on Earth is at the feet of someone who's already done what you're trying to do.'

I've got scars, I've got battle wounds, and this is why I do now what I do. Because I want to help other people building companies gain from my pain and be able to become more knowledgeable as they go and grow their businesses. So now what I do is I do what I've been doing for many years of my life.

I coached my kids in all sorts of sports, so now I am an Entrepreneur Coach. And I want to help you build your company and ultimately live your dream life. That's enough about me."

FREE DOWNLOAD: Savage Secrets Cash Flow Tracker™

"At the end of this, I'm going to share with you this spreadsheet that I've used in all of my businesses. I've shared it with thousands all over the world. It's a simple cash flow spreadsheet. If you're not a numbers person--don't worry about it! It's plug and play. It's fill in the blanks. It's customizable.

It's done in Microsoft Excel, but you can export it to Google Sheets, if that's what you prefer to work with. But i'm going to get you that information once we get to the end."

A Quick Breakdown of Business Financials

"Let's now talk about business and financials. There is one thing that we need to do when we play this game of business and that is we need to keep score, right? That's how we do it. We keep score with numbers. And it doesn't matter if you're running a non-profit or you're running a for-profit business. Numbers are involved.

There are predominantly 3 sets of financial statements that we use when we're running businesses. They're called the Income Statement, the Balance Sheet, and the Statement of Cash Flows. Now, don't get overwhelmed by this! I'm going to step through it really simply. I'm not going to get into a whole ton of detail on income statement and balance sheet. I'm going to talk about cash flow today because cash flow is the life of your business."

Income Statement

"The analogy I always use is that an Income Statement is like a Report Card. You go to school for a period of time, and at the end of that period of time you get a grade. A, B, C, D, F. Pass or fail. An income statement is your results over a period of time. It could be monthly, it could be quarterly, it could be annually. It could be month over month, quarter over quarter, year over year. Whatever it is, it's only your report card for a period of time. Super valuable because it is part of keeping score, but it's based on a period of time."

Balance Sheet

"The second financial statement is a Balance Sheet. A Balance Sheet is exactly what it sounds like. You know, you have assets in your business, you have liabilities, and if you take your assets and you subtract your liabilities that is the net value of your business. But a balance sheet is a moment in time, whereas an income statement talks about stuff over a period of time. Or it gives you results of things over a period of time. A balance sheet is giving you a snapshot at one moment in time. It could be end of the month, end of the quarter, end of the year. You can also take that information, your assets and liabilities, and compare it to prior periods. But a balance sheet is one moment in time."

Statement of Cash Flows

"Now here is why we're here today: CASH FLOW! Think of cash flow as your heart pumping blood throughout your body. Cash flow is constantly working. Your heart, if you're alive (if you're dead it doesn't work), but your heart is constantly pumping blood throughout your body. This is so essential to entrepreneurs building and growing companies. Absolutely critical. And this is something that has to work all the time.

We can't take our eye off it. It's like, you want to take care of your body? You got to do it all the time. It's not something you can do, you know, at a moment in time or over a period of time. Cash is crucial. As it pumps through your business, you need to really have a strong understanding of it."

Step by Step Walk Through with a Real Life Example

"Now what I'm going to do is, I'm going to tell a story about a business. A lot of the facts are coming from stuff that I've experienced over the years. This isn't my business, but I know that you will get a much better understanding of cash flow when we look at it from a real life perspective.

Now if you are allergic to spreadsheets, please don't worry. I'm going to make this easy. I'm going to show you some pictures and talk through some things about spreadsheets.

The first thing is this.

It's a simple spreadsheet. It just talks about cash in and cash out. Step one is every single month we start off with cash in the bank. It could be cash in the bank, it could be investments, it could be a variety of things. But we start off with a certain amount of cash.

So that's our starting cash and then throughout the course of a month we bring cash in. Hopefully, you know, if your business is cranking, you're bringing cash in. Cash can be coming in from a variety of sources, but I'm going to get into that in a bit.

And then ultimately, we have our total cash in, which is the sum of all of the sources of cash. And then our total cash available. Total cash available throughout the month is cash that you had when you started the month plus all this cash that's come in. So that's the fun part, right? That's the cash coming in part.

Now here's the not so fun part, cash going out. Actually I shouldn't say that. There are a lot of good things that we spend our cash on like employees and things like that. But when we spend cash there are a number of areas that we can spend cash on. I'm not going to talk through all of the details, of all the different areas, of all of the departments, of all the things that are on your income statement where cash goes out. This is just an example of a few things where our cash can go out. It can be our salary, can be payroll, it can be benefits, it can be IT, it can be infrastructure, it can be SIC marketing expense, it can be a variety different things. It can be inventory, it can be capital equipment. Cash goes out.

So when you take your starting cash, and you get your cash in, and thus you have your cash available for the month. Now you got the cash going out. There's total cash going out, there's net cash for the month, and then ultimately, there's ending cash. Now when we look at this, this is the month of January, right? So we started with some cash, we added some cash, we subtracted some cash, we ended the month with some cash.

There are things that go on in this business during the month of January. The first thing, this is an exciting business, it's really grown. They got a million dollar order from a big company. In order to execute on that order, they need to buy some tooling, which is going to cost some money. And because they're a startup business, they're actually going to have to pre-pay their inventory. Okay, so if you get a million dollar order, and you have to pre-pay inventory, you might be writing a pretty good-sized check. My point here is, when we finish the month, finish the month of January, it can be any month. Whatever our ending cash is in January, is our starting cash in February.

Now the same analogy, the same story, the same execution happens in the month of February, right? So in the month of February, we are going to bring cash in. We're going to spend cash and in this particular example we are going to have our normal monthly expenses, but we are also going to have to purchase some tooling, like I said. We got to invest in that in order to execute. And we have to buy some inventory.

This does not have to be the same for your business, you may not be buying inventory, but you may be spending stuff in certain months of the year, that you may not be spending in different months of the year. So it's essential to capture those pieces of cash that are going out.

In this particular example, we start the month with a certain amount of cash, we bring in some cash, we spend some cash, and ultimately, based on what this spreadsheet is showing, it is showing that we have a negative ending cash position.

Now, we all know that you cannot have a negative ending cash position. What we need to do is, we need to figure out how to bridge that gap. And the way that we're going to bridge the gap is we're going to access our line of credit.

Guess what? I am making an assumption that you have a line of credit. You may not have a line of credit. That would only mean that you're going to need to access cash from a variety of different other sources, and I'm gonna touch on those in a little bit.

The reality is right now we went through this situation in January, now we've got enough cash to get through the month of February. Also other things happened in the month of February. Now this is normal business stuff. You can't always predict things that are going on. What we're going to do in February is we're going to hire some more staff. We also found out that our e-commerce sales in this particular company went down, and because of Covid and the increase in logistics costs, our cost of goods have gone up. Now we're going to go through the same exact situation and scenario as when we finished January.

So now we finished February and we start with a certain amount of cash. When we go through the journey of February and our cost of goods go up and our e-commerce sales go down, and we add staff because we're looking to build our business and we need more people to execute on the orders, what happens? It again shows that we're in a negative cash position at the end of March.

We know we can't be at a negative cash position at the end of March. So we need more access to capital and in this particular situation, this month, in order for us to ensure that we can meet all of our obligations from a spend perspective, we need to find cash from a different situation. This example is my own personal cash, or our personal cash, or your personal cash. You are going to put in 150 grand of your own money this month to make sure that you're able to execute on your game plan.

So we've taken cash from a line of credit, we've taken cash from our personal funds, and same exact situation happens in the month of April. Ending cash in March is our beginning cash in April. Same scenario. We go through the entire month, we would not have enough cash, so now we need to find cash from another source. So if we don't have any more cash, if our line of credit is maxed out, what's next? Friends and family. Now I'm using these three things as an example. A line of credit is a source of cash, our personal funds is a source of cash, our friends and family is a source of cash, our home equity line is a source of cash, our credit cards are a source of cash. There's multiple sources. You can factor invoices. Which basically means, if someone owes you $100,000, and you need cash right away, you can sell that invoice for $100,000. And they may only give you $90,000 or $80,000 for it, but when businesses are growing, cash is required. So we have to be creative.

In any event, in order to get through the month of April, we need to access more cash. And then when we go into the month of May, what we did was, fortunately we went back to our bank. And we talked to our bank and said, "Hey, guess what? Our business is really exploding. Can you increase my line of credit?" So the bank increased our line of credit.

Now there's a reality. We have now tapped other sources of funds in order to get through the first five months of the year. We had to find cash in order to get our bills paid, to pay our employees, to pay all the rest of our bills, we needed to find cash.

Now, why are we dumping all this cash in? We're dumping the cash in, because we believe that there is going to be a windfall of cash at some point as we continue to go through the year, right? We got ourselves a million dollar order previously.

And so here's what happens in June. All of the good stuff that we've been working for over the course of the last five months has now come to fruition. Not only did our e-commerce sales go up for the month, but we also got paid for a million dollar order from our customer. And when you go and look at the cash situation right now, where the previous five months we're ending the the month in a negative cash position. And we're in a negative cash position each month for the first five months, we had to offset that cash position with funds from different areas.

We needed cash. Now it's basically the analogy of, you know, you have planted all the seeds and now you get to reap the rewards of those seeds. At the end of June, we finish the month in a unbelievably positive cash position. Now this is great and we can take this cash we can sit right here, but when we look at all of the other places that we had to borrow cash from in the previous six months, we may want to go and pay that back.

Now our ability to pay all that back is there. We borrowed $600,000. We took some money from the line of credit, we took some money from friends and family, we took some money of our own personal cash reserves, and now we could if we wanted to, at the end of June, we can pay all this back. This is the beauty of having a cash flow statement.

Now your business may not be here. Your business may be bigger than this, your business may be smaller than this, guess what? It doesn't matter. Just remove a zero or add a zero. The formulas are all the same. Trying to cash flow a business is absolutely, positively brutal. It's challenging, but it's so necessary.

This is one of the greatest competencies, in my opinion, of any entrepreneur. If you are growing. I think it's very difficult for businesses to just exist and not grow, because the reality is the world is changing around us all the time. The world is constantly changing, so if we're not trying to grow and we're not trying to change and we're not trying to adapt, then it's going to be a challenge on a go-forward basis.

In any event, what I'm showing here is that we had the ability to pay down the cash. Managing cash, this is not super hard. The spreadsheet that I will share with you at the end, plug the numbers in, the formula is all done for you. You can add different rows and columns and things like that. But ultimately, your ability to manage cash--it doesn't matter the size of your business--many companies have gone out of business because their businesses grew. "Oh things are going great! This is this is fantastic! My business is growing!" How about cash? How about cash?

We all know the saying, we've all heard the saying, "Cash is king." It really is. There's lots of things, lots of areas in our businesses, from marketing and sales and product development design and manufacturing, there's lots of stuff we need to do. We cannot take our eye off cash. It's essential. Especially if you are a growing business."

5 Cash Flow MUSTS

"I'm gonna finish with this: there's 5 cash flow MUSTS.

Number 1

Know your numbers. You know we keep score in business with numbers. Now there are other reasons we start companies and run companies and build companies--there's satisfaction and there's personal growth and there's you know that that desire to be on your own. There's a lot of reasons. But we got to keep score, because if we don't keep score, we don't know if we're winning or losing. And we're not going to know what steps we need to take next if we don't really have a good handle on the numbers. So you got to keep score.

Number 2

Number 2 is, especially as a young, growing business, as an entrepreneur we oftentimes do not have the ability to grow the business without cash. Most companies if you buy a franchise you could be dumping in a million, a couple million bucks just to start. Could be your own funds ,whatever it may be, you may have to borrow money. Especially if your business is growing. You want to ultimately get a line of credit from a bank or you want to get financing. You want to talk to an investor. Anyone that's going to give you money (except maybe mom and dad) anyone that's going to give you money is going to run a credit check on you. So if you don't have great credit, work on improving it. If you do have great credit, hold on to it like a baby!

Number 3

In advance! In advance, when you're when you're not needing cash, think about where you might be able to get it. Could it be home equity lines? Could it be lines of credit? Could be friends or family. Could be parents. Could be wherever. You may need to possibly get cash. As you start to grow your business, there are going to be curveballs. You know Mike Tyson says, you know, "Everybody has a plan until they get punched in the mouth." It happens in business all the time. Things happen that we don't expect. If you can just at least create that list of different areas, sources of cash, that you might need as you're growing.

Number 4

I encourage you to create a 12 to 18 month cash flow statement. You know, like i said, the spreadsheet that I'm going to give you access to has all of the formulas built in. It's already done for you. It's a 12 month cash flow and you can plug your numbers in and see where things are going and estimate where you may want to get cash. Yes, there are some assumptions that we need to make in business. We need to forecast sales, we need to forecast if we have receivables. How many people are going to pay me within 30 days, 45 days, 60 days? If we have payables, are there ways for us-- and that's actually even another source of funds-- we can go and talk to our our creditors or people that we owe money to and say, "Hey, you know, I know I told you I'd pay you in 30 days. Is there a way I can pay you in 60 days? I'm going through a growth phase right now in my business." Identify the sources of cash and put together that cash flow spreadsheet 12 to 18 months.

Number 5

And finally, I'm gonna, you know, this is a shameless plug. But I do not care--actually I shouldn't say it that way. I would love to be able to work with entrepreneurs that are within, you know, the areas that I focus on. But if it's not me, please get a coach or a mentor. You know oftentimes, they'll say, 'Well I've got a bookkeeper and I've got an accountant.' I have bookkeepers and accounts. I've had many bookkeepers and accounts. Lots of times, they're not really versed on cash flow and cash management in growing companies. Get a mentor or someone--you know, they have fractional CFOs, or people that you can hire that can just sit there and help you understand the numbers and help you with the assumptions that you're going to make on your business. It is critical to get these external eyeballs looking at your business, looking at your financials. It could be people on your team. It could be members of your team, but have another set of eyeballs. You're the entrepreneur. You're the one driving the ship here, and I'm challenging you to say, "Alright, I gotta dig deep. I've gotta go and I've gotta figure out who else I can get to help me grow my business."

There is a reality, I'm not gonna just say to building companies, there's a reality to life. There are only two ways to learn things: your experience or someone else's. And when it is your experience, it usually hurts more, costs more, and takes longer. So if you are looking to avoid pain (hurts more), (cost more) if you're looking to save money, or (it takes longer) looking to save time, sit at the feet of someone who's already done what you're trying to do.

I don't just preach this, I have coaches in my life. I have three coaches in my life! This is sounding like a sales pitch... this is not a sales pitch, but I'm challenging you to get different voices. If you are exactly where you want to be in your life, great! Don't worry about it. But if you're looking to take your business and life to another level, it's essential to get that external input. It could come from from books, from podcasts, from videos, wherever it may come, but get that other input into your brain if you want to take your life and your business to another level. So that's my shameless plug for the day.

So, if your bathroom mirror is your board of advisors, it might be fun to invite Mike to the next meeting.

I'm going to leave with that.

FREE DOWNLOAD: Savage Secrets Cash Flow Tracker™

"Here is the information to download this spreadsheet. You can go to https://thesavagesecrets.com/cashflow. When you get there, it's going to give you the opportunity to download this spreadsheet. Like I said, the spreadsheet is in Microsoft Excel format. It can be converted to Google Sheets, if that's something that you prefer.

But it's a simple spreadsheet I've created. All the formulas, you know, there's certain areas that you can just plug and play, and if you have any questions please shoot me an email at [email protected].

I'm always eager to hear your stories, your successes, help you through your challenges. If you'd like to learn more about the different programs that I have in working with entrepreneurs, again please shoot me an email. Just let me know what your questions are and I'll get back to you. I really, really hope that you enjoyed this. You may not be a numbers man or woman like I am, I love numbers because I just enjoy, I don't know, maybe I'm just anal, or it's my engineering background or whatever it is.

But I just know you can't win this game of business unless you keep score. And one of the key essentials in keeping score in your company is making certain that you have a handle on cash flow. Have an amazing day! I'm gonna leave you with that. Dream big! Go kick some butt, and I look forward to seeing you on the next training."